The monthly cost of retirement varies significantly based on individual circumstances, such as lifestyle, savings, and planned activities. Here are some detailed insights to consider:

General Considerations:

- Lifestyle Choices: The kind of retirement you envision plays a significant role in determining monthly expenses. Will you travel frequently, start a business, or lead a minimalist lifestyle?

- Health and Medical Expenses: As you age, medical expenses might increase. Having a comprehensive health insurance plan can help manage these costs.

- Inflation: Over time, the cost of living increases due to inflation. It’s essential to adjust your retirement savings to account for this.

Malaysia’s Context:

According to the Malaysian Employee Provident Fund (EPF), the basic savings target is around RM240,000, which translates to approximately RM1,000 a month for 20 years of retirement. However, this does not consider private savings or a preferred retirement lifestyle.

Income Groups:

B40 (Bottom 40% Income Group):

- Average Income: RM3,401/month

- Retirement Needs: 2/3 of last drawn income = RM2,267/month

- 20-Year Savings: RM544,160 (adjusted for 2% inflation: RM808,593)

- Estimated Monthly Cost (Inflation-Adjusted): RM3,369

M40 (Middle 40% Income Group):

- Average Income: RM7,971/month

- Retirement Needs: 2/3 of last drawn income = RM5,314/month

- 20-Year Savings: RM1,275,360 (adjusted for 2% inflation: RM1,895,118)

- Estimated Monthly Cost (Inflation-Adjusted): RM7,896

T20 (Top 20% Income Group):

- Average Income: RM19,752/month

- Retirement Needs: 2/3 of last drawn income = RM13,168/month

- 20-Year Savings: RM3,160,320 (adjusted for 2% inflation: RM4,696,069)

- Estimated Monthly Cost (Inflation-Adjusted): RM19,567

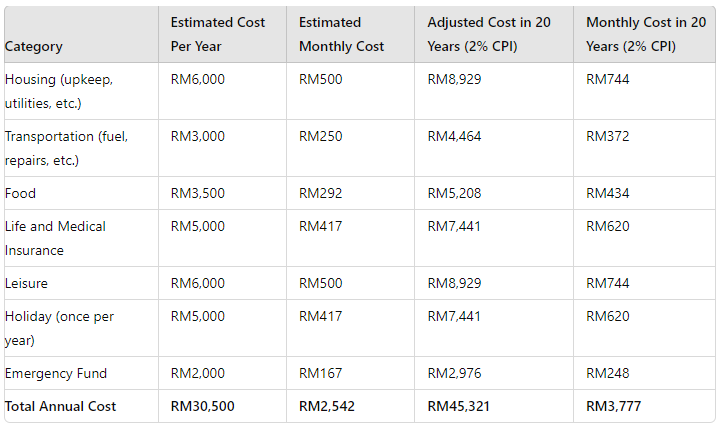

Minimalist Approach to Retirement:

For those opting for a minimalist lifestyle, here’s a ballpark estimate of annual and monthly costs, assuming no outstanding debt:

Starting a Business:

- Initial Costs: Varies depending on the business type. For instance, a home-based cake baking business might require RM1,260 - RM3,100 to start.

- Income Potential: Selling cakes at RM30 to RM100 each, fulfilling two orders a week, can yield RM240 to RM800 a month.

Traveling and Education:

- Example: If your last drawn income was RM5,700, your retirement income should be around RM3,800/month. For 20 years, this amounts to RM912,000. If you add the cost of further education (e.g., RM28,000 for an MBA at Universiti Malaya), your savings need to increase to RM940,000.

Conclusion:

Planning for retirement involves considering your desired lifestyle, potential health expenses, and inflation. The estimates above provide a guideline, but personalizing your plan based on your specific needs and goals is crucial for a secure and fulfilling retirement.